I Love You Trust

Care Smarter. Crafting a revocable living trust is an act of love, safeguarding your family’s future.

How We Love

Keep Control

Provide More For Those You Love

Protect It From Predators & Creditors

What happens if you

don’t have a plan?

No Guardianship Control

If something happens to you, the court—not you—decides who raises your kids. Without clear instructions, family members could argue over who takes care of your kids and how assets are managed.

Immediate Care Gaps

Without short-term guardianship, your kids could be placed in foster care during emergencies.

No Inheritance Control

At 18, your children could inherit large sums without guidance, leaving them at risk to bad decisions or predators.

Unnecessary Probate Costs

Probate can cost 5-10% of your estate, taking money meant for your kids.

The Life & Legacy Planning Session

Your First Step Toward the Outcomes You Want

In this session, we'll map out what would happen with your current plan—or lack of one—and design a new plan to ensure your vision becomes reality.

Step 1:

Discover the Most Likely Outcomes of Your Current Plan

Step 2:

Explore Your Goals & Strategies to Overcome Your Challenges

Step 3:

We Design Your Plan Together

Financial Protection

Manage and safeguard your children’s inheritance, ensuring their assets are protected from misuse, creditors, and financial predators. This allows their inheritance to support their growth, education, and well-being responsibly.

Avoiding Probate Court

Keep your children and their inheritance out of probate court, saving your family time, money, and the emotional stress of legal battles. This ensures a smooth and private transfer of assets according to your wishes.

Legacy Interview

Record a personal video message for your children, sharing your life stories, values, and hopes for their future. We provide guided questions in categories like life lessons, wisdom, family history, beliefs, and dreams, allowing you to leave behind a meaningful connection.

Families With Kids Young & Old

Tailored estate planning to secure your children's future. Trust setup, guardianship designations, and education fund strategies for peace of mind.

Business Owners

Comprehensive estate planning for business continuity, tax-efficient wealth transfer, and succession strategies to protect your life's work.

Real Estate Investors

Estate plans designed for property asset protection. Real estate succession, tax minimization, and efficient property management directives.

Doctors

We build systems to control the unique concerns and goals of physicians. Asset protection, medical practice structuring, buy-sell agreements, and strategic tax reduction planning. Safeguard your professional and personal financial health.

Entertainers, Artists & Professional Athletes

Estate strategies tailored for public figures, safeguarding royalties, image rights, and long-term wealth.

Art Collectors

Specialized estate planning for art collectors. Provisions for valuation, conservation, and curated art succession.

Tech Investors

Estate planning for tech portfolios. Intellectual property trusts, digital asset management, and startup equity distribution strategies.

Blended Families

Customized estate plans respecting diverse family dynamics. Includes stepchild inclusion strategies, asset distribution fairness, and trust structures.

Professional Women

Empowering professional women with estate planning for longevity, career breaks, wealth growth, and multigenerational care with thoughtful, goal-oriented strategies.

Keep Control

In life, you reap your Revocable Living Trust’s benefits; later, the trust shifts to provide for the next in line according to your wishes.

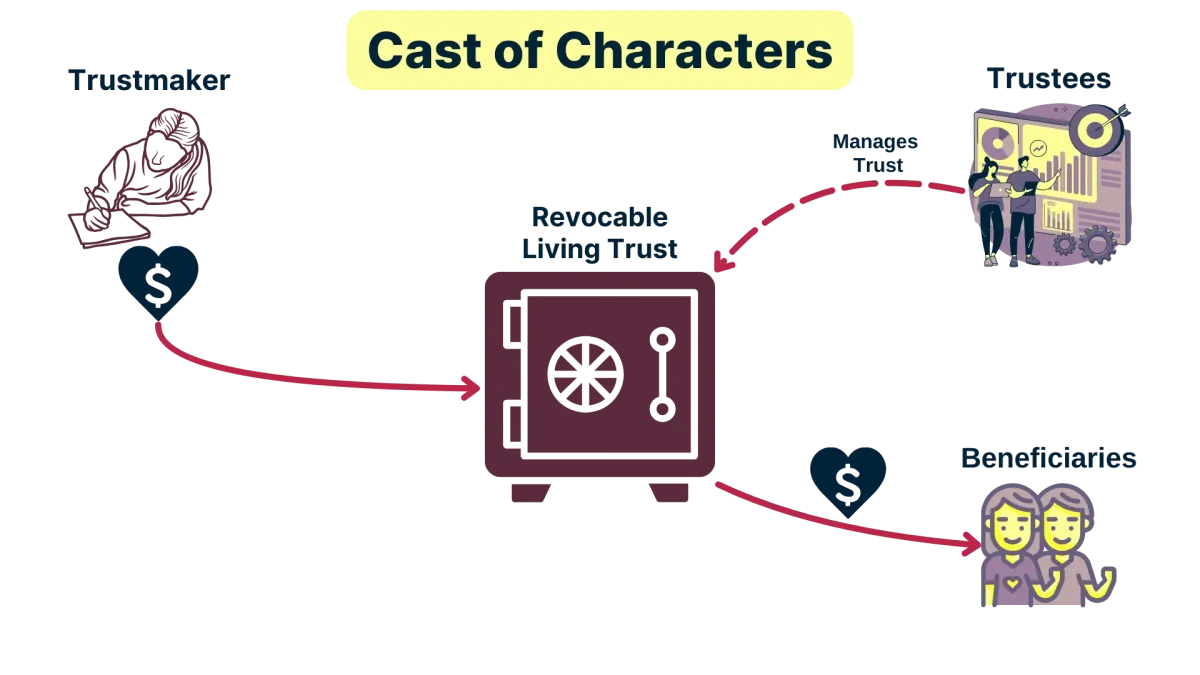

The Trustmaker

The creator of a revocable living trust, the trustmaker, is responsible for transferring ownership of their assets into the trust. This individual retains the ability to modify or dissolve the trust during their lifetime, maintaining control over their estate while planning for future management and distribution.

The Beneficiaries

Beneficiaries are the individuals or entities designated by the trustmaker to receive the assets from the trust. These recipients benefit from the trust upon the trustmaker's death or other specified events, receiving their inheritance directly per the terms set forth in the trust agreement.

The Trustees

Trustees are tasked with managing the trust's assets in accordance with the trustmaker's instructions. They have a fiduciary duty to act in the best interest of the beneficiaries, handling responsibilities such as investment decisions, asset distribution, and administrative tasks, ensuring the trustmaker's wishes are carried out effectively.

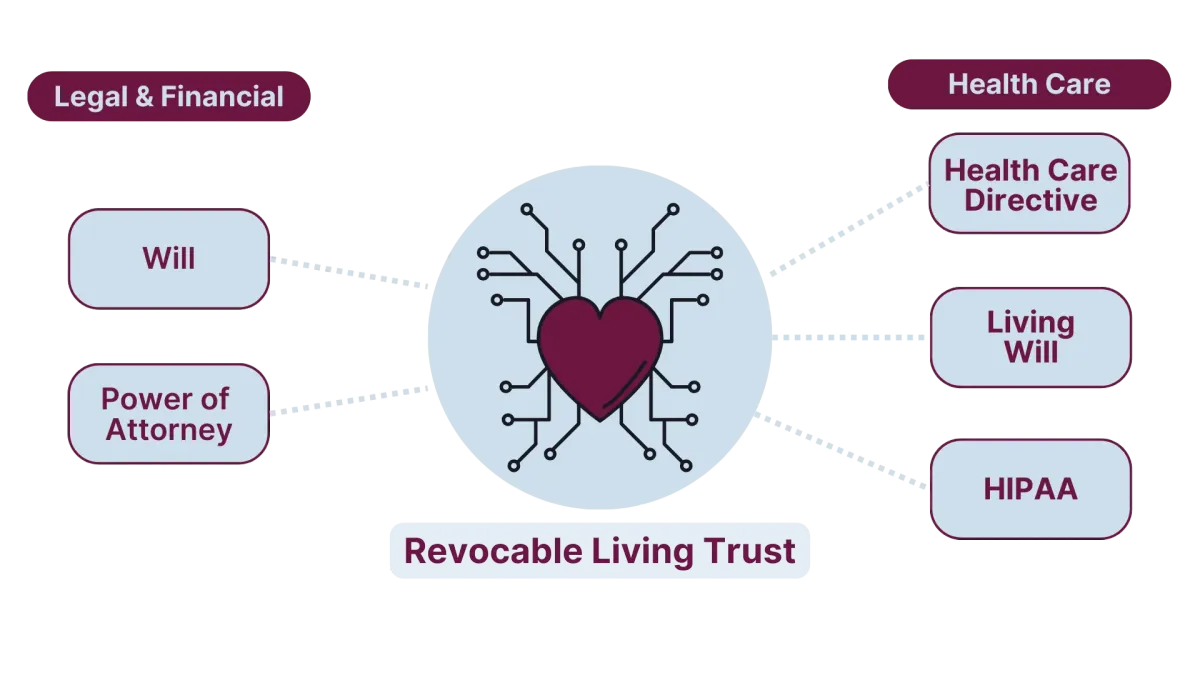

Essential Components of Every Plan

Tech Investors

With a Revocable Living Trust, you maintain comprehensive control over your assets while alive. This living document is crafted to adapt to your changing needs, allowing you to amend trustees, beneficiaries, and stipulations as desired. It's a living blueprint for your legacy, ensuring your wishes are executed with precision and personal intent.

Through this trust, you ensure continuity, safeguard your estate's privacy, and establish a clear directive for the future—all under your control.

Will

A pour-over will ensures that any assets not explicitly included in your Revocable Living Trust are 'poured over' into it upon your death, providing a safety net to catch any overlooked assets. This document works in tandem with your trust, ensuring complete control over your estate's distribution and preserving the integrity of your estate plan.

It’s a critical component, securing that all your assets are accounted for and managed according to the trust's terms, guaranteeing no asset is left without direction.

Durable Power of Attorney

A Durable Power of Attorney is a key element in estate planning that grants a trusted person authority to manage your affairs if you're incapacitated. This enduring document remains in effect even if you're unable to make decisions, ensuring continuity in financial and legal matters. It provides reassurance that someone you choose and trust can decisively act on your behalf, maintaining control over your assets and affairs according to your guidelines.

It's an essential safeguard, ensuring that your estate is competently and reliably managed under any circumstances.

Health Care Directives

An Advance Health Care Directive appoints a trusted agent to make medical decisions on your behalf, ensuring your health care is managed as you would wish if you're unable to communicate. Living Wills articulate your preferences regarding life-sustaining treatments, keeping you in control of your medical care. HIPAA Authorizations grant your designated individuals access to your medical records, allowing for informed decisions about your health and ensuring that your privacy preferences are respected.

Together, these documents form a comprehensive health care directive framework for your estate plan.

Our Services

Tax Reduction Planning

Navigate complex tax landscapes with our comprehensive tax reduction planning. We offer tailored strategies to minimize your liabilities and maximize estate value—ensuring more of your legacy reaches your loved ones while remaining compliant with ever-changing tax laws.

Asset Protection Planning

Safeguard your hard-earned assets against potential future creditors, lawsuits, or judgments with our asset protection planning. We create robust legal structures that preserve your wealth, providing you peace of mind that your financial legacy is secure for generations to come.

Inheritance Structuring

Ensure your legacy is passed on according to your wishes with our inheritance structuring services. We carefully craft your estate plan to address individual beneficiary needs, mitigate tax implications, and avoid probate delays, creating a seamless transition of your assets.

Business Structuring

Our business structuring services provide the foundation for your company's success and longevity. We help you select the right entity type, draft agreements, and create mechanisms for growth, all while positioning you for optimal tax and legal advantages.

Business Succession Planning

Plan for the future of your business with our succession planning services. We design a custom roadmap for leadership transition that aligns with your business goals, ensuring continuity, minimizing tax burdens, and maintaining harmony among successors and family members.

Retirement Planning

From an estate planning perspective, our retirement planning services ensure your nest egg is protected and efficiently transferred to your beneficiaries. We work with you to integrate retirement accounts, like IRAs and 401(k)s, into your estate plan with tax-efficient strategies that align with your legacy goals.

Disability and Health Care Planning

Proactively prepare for unexpected health challenges with our disability and health care planning. We establish clear directives for your care preferences and financial management, ensuring that your well-being and dignity are upheld even when you can't advocate for yourself. Our plans include durable powers of attorney and advanced health care directives tailored to your specific wishes and needs.

Get In Touch

Tax & Wealth Law Systems

1 World Trade Center

85th Floor

New York, New York 10007